Uncertainties in Sectoral Investment Decisions - Part 1

Primary Section | Article no: 3 | The booming sector can generate more value for the country, but it doesn't always benefit shareholders.

Do you consider investing in sectors like AI, Defence, Semiconductors, or EVs that you believe are the future? This write-up, presented in two parts, intends to provide key insights to consider before making your investment decisions in the preferred sector.

In this write-up:

Explanation of the crucial parts that often go unnoticed when making sectoral investment decisions.

Examination of inherent risks, potential gains, and losses.

A comprehensive study with real examples of different listed companies.

360° Arc: Think & Unfold

When Investing, we often hear the advice to invest in booming sectors. Renewable Energy, Electronics, Artificial Intelligence (AI), and Electric vehicles (EVs) are promising industries that are expected to be the future and pillars of national growth that drive GDP growth, massive job creation, innovation, and technological advancements.

But here are the interesting questions that every investor must think about — Does a booming sector always promise shareholders return? What are the sector-specific challenges that a company from the sector might experience? It's necessary to act upon your research and analysis instead of someone's advice. You're required to think & analyze in 360°. Let's unfold each angle in research and analyze it one by one.

Role of Government

As a foremost part, let's understand the role of Government. The government plays a crucial role in identifying emerging trends and sectors that require substantial investment and special attention to shape a better economic future for the country. By allocating more funds to these areas, the government implements effective policies, offers incentives, provides tax benefits, and improves infrastructure and the overall ecosystem. These actions attract many private and government entities and lead to significant growth in the targeted sectors.

Significant institutional investments will flow into those areas, and many micro, small, medium, and large companies will emerge. The existing companies may further advance in terms of growth. Those sectors will boom, and there is no doubt that this cycle will ultimately contribute to the overall economy of the country on a large scale if there is no mismanagement and corruption, provided that the global demand supports the growth in targeted sectors.

Crucial Aspects Often Overlooked

Many high-growth sectors require massive capital investments. To scale up the operation fast, they often rely on external debts and equity. Capital-Intensive sectors may have high debt levels as they require a lot of investments toward Plants, Properties, and Equipment. Companies with high debt may face financial risks in future if they do not attain the growth & returns as expected.

When a sector is thriving, many new companies emerge. When more companies enter the sector, the competition within the sector intensifies, leading to potential saturation in the market. It means that when more companies are involved in offering a particular service or product, the profit margin declines due to price-related pressure from peers. This potentially hinders the growth of companies that sell that same particular product or service at higher prices — They may not be able to sell it at lower prices if they can't manage their expenses. This eliminates those companies from the growth race. This factor is more pronounced for sectors such as Renewable Energy solutions, E-commerce, etc.

Each sector has its own set of challenges. Hence, it's essential to take into account the sector-oriented challenges. Identifying such challenges and knowing how they impact the target companies is a crucial part of investing.

For example, The Renewable Energy sector faces several challenges that affect its growth, profitability, and scalability. Despite being a booming sector, it has many challenges, such as cost competitiveness, the need for efficient and cost-effective energy storage solutions, the requirement for large land areas and infrastructure developments, uncertainty in government policies and other regulatory challenges, and many more.

Similarly, The Electric Vehicles (EVs) Sector faces challenges such as rapid technological advancements, inadequate charging infrastructure, performance discrepancies, market saturation, limited after-sales services, vulnerability to economic cycles, difficulties in price differentiation, and so on.

Uncertainty in government policies and regulatory changes can affect the stability of sectoral growth. It slows down the growth of a booming sector by reducing the investors’ confidence, increasing costs and disrupting the long-term planning of companies.

It has been observed that listed companies from booming sectors are often traded at peak valuations. Do you know why this happens? — Speculation is a reason that drives rapid increases in share price. Some behave like an astrologer— predicting the future earnings of that company to justify the present value. When their prediction fails and expectations aren't met, the stock price declines heavily. Therefore, always keep your speculative behaviour set aside. Never make investing decisions without underlying and supporting facts, and no matter what & how appealing the investment may seem, never overpay. We cannot be certain about the future earnings of a company as we are neither the CEO nor a supernatural fortune teller.

A Double-edged Sword

I acknowledge that an investor can gain huge returns from his investment in a growing sector. However, there are significant risks associated with it as well. This emphasizes the importance of taking substantial measures by an investor to protect his wealth. Throughout history, there have been several instances where it has been shown that not all companies from a booming sector achieved success. In fact, in some cases, it has been observed that even the market leaders have struggled for extended periods. Let's explore one of such most popular instances;

Dot-Com Bubble:

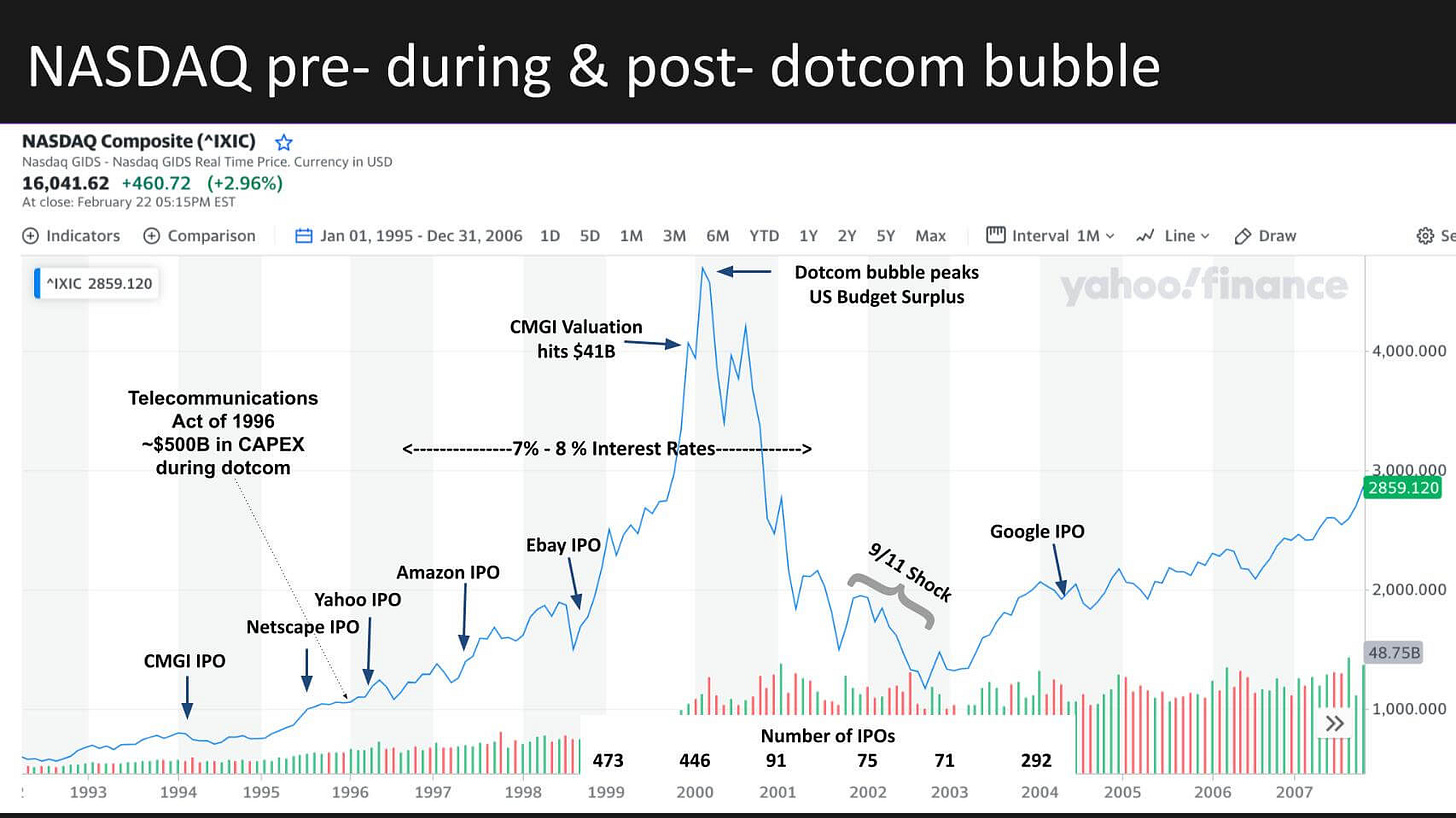

The Dot-com bubble was a period between the late 1990s and early 2000s. During this period, speculation led to the rapid rise and subsequent crash of many internet-based companies’ stock prices. It was peaked between 1997 and 2000. The technology companies’ stock prices were over-inflated. Almost many of those companies had un-proven business models. Most of them were not yet profitable. People believed the internet would be the future. So, Internet-based companies were their favourite and the most popular investment destinations. This speculative bubble burst in 2000. Result? — Massive wipeout of shareholders’ wealth. The following image shows the graph of the United States one of the stock market indices — the NASDAQ Composite, during the period of the dot-com bubble.

There were some prominent players in that period such as Pets.com ( an online pet supplies retailer), Webvan ( an online grocery delivery company), AOL-America Online ( The largest dial-up internet service provider), Yahoo, Lycos ( Search Engine & Web portals, Rivalling Yahoo), CMGI ( a venture capital firm heavily invested in internet-based startups), CISCO ( a networking equipment manufacturing company), etc. They reached their peak valuation between 1997 and 2000. Many investors and analysts claimed that those are promising companies. But exactly the opposite happened.

Wealth Destroyers:

Pets.com raised $82.5 million in its IPO in 2000. They burned cash in high marketing expenses and failed in pricing. Later, it became bankrupt just nine months after its IPO.

Webvan raised $375 million from IPO in 1999. They had reached a market cap of $1.2 billion at its peak. They were investing heavily in infrastructure without achieving profitability. Eventually, this made them to declare bankruptcy in 2001.

AOL -America Online shone as the largest internet service provider during the 1990s. They provide dial-up internet and content services. In 2000, they merged with Time Warner for a $165 billion deal, which led to clashing corporate culture and declining dial-up subscribers due to technological overlapping of broadband-based internet service. Then, in 2009, they demerged and were later acquired by Verizon.

Yahoo was valued at over $100 billion at its peak. Lost its market share to Google as they were struggling to monetize its services. Later, It was acquired by Verizon in 2017 for just $4.8 billion— a fraction of its peak valuation. An interesting thing is Yahoo once failed to acquire Google in 2002 for $5 billion.

Similarly, Lycos lost its position to Google in the search engine market. Also, frequent changes in ownership through several acquisitions affected its business

CMGI invested heavily in internet startups during the bubble. It reached a market cap of $40 billion in 2000. After bursts, they witnessed a drastic wipeout of their wealth by their portfolio companies, leading to a rapid fall of over 95%. They restructured & renamed as ‘ModusLink Global Solutions’ and shifted to supply chain management. They never reached the same level of prominence as before.

CISCO went public in 1990. They became dominant with their products which are essential for internet infrastructure. Stock prices surged. In early 2000, it became one of the most valuable companies in the world with a market cap of more than $500 billion. After the bursts, the stock price fell more than 80%, resulting in a huge loss of market cap to $100 billion. They have not yet achieved a market cap of $500 billion since the burst— $236 billion at present.

Value Builders:

Amazon was established as an online bookstore and went public in 1997. During the peak of the dot-com bubble, the stock price soared to $107. Post bubble, it crashed by 95% approximately—traded at $5.3. Despite revenue growth, they struggle to show profits in their book. In 2002, Amazon entered into the cloud Business and later in 2006, they established Amazon Web Services (AWS). They diversified into various other models such as Prime Subscription, Kindle e-books, Electronics, Consumer Goods, and online retail. Both revenues and profits surged. Amazon became the go-to platform for e-commerce and digital services. In 2018, It achieved a $1 trillion valuation. It rewarded long-term shareholders with multiple splits and huge capital gains.

EBay was an online auction platform, facilitating person-to-person trading of collectibles. It was founded in 1995 and its revenue showed a massive 10× jump from $4.7 million in 1997 to $47 million in 2018. Then, It went public in 1998 and became a major player in e-commerce. eBay was profitable even in the bubble period which was uncommon among internet-based companies in those days. After bursts, they expanded globally, grew their revenue substantially and remained profitable. Post 2008, they restructured their business by moving away from its auction-oriented modes to the ‘Buy it Now’ model, to compete with other e-commerce players. The shareholders benefited from splits and dividends. Investments in eBay rewarded good returns to them.

Google was established in 1998 and focused on search algorithms. During the dot-com bubble, many startups without proper & sustainable business models went for IPO while Google avoided such hype and focused on search engines and ads. In 2000, they started monetizing via AdWords which is a pay-per-click advertising model. They were profitable when competitors like Yahoo and AltaVista struggled post-bubble. After two years, they introduced Google News, expanded AdWords, and acquired Blogger.com. They generated over $3 billion in revenue and then went public in 2004, leading to a market cap of $23 billion. Google grew rapidly and exponentially following the acquisition of Android Inc and YouTube in 2005 & 2006 respectively. In 2015, they created a parent company named Alphabet Inc to sperate the core business from experimantal ventures. As of 2025, their market capitalisation is $2397.28 billion which is 103 times higher than their IPO market cap. The shareholders benefited with approximately 6500% — after adjusting for splits—of capital gains in last 20 years.

Indian Stock Market:

The Indian Stock Market was not impacted primarily by Dot-com bubble as in the US, but had felt the ripple effect from the US market. The Indian Stock Market experienced similar tech boom by Internet & IT companies due to the liberalisation of Indian economy and Dot-com Bubble— but on a smaller scale compared to United States.

I know this post is quite lengthy. So, I'll continue in the next part. Let’s discuss the lessons taught by past and what course of action we must follow in the upcoming part. Stay tuned! Don't miss it! Your investment in knowledge is a powerful asset! Remember that!

Click on the below to read Part-2:

⚠️Disclaimer:The Value Investor's Lab is dedicated to providing educational content to help readers understand the principles of value investing. We do not promote or recommend specific companies, securities, or investment strategies. Readers are encouraged to consult registered and approved financial advisors for personalized investment decisions.