The Business of Indian Commercial Banks: A Complete Guide for Value Investors—Part 1

Primary Section | Article no: 5 | Building on the fundamentals to deepen your understanding of banking businesses.

The basic and most important practice in value investing is understanding the sector in which the company operates and its business model. This write-up is specially made for those who would like to understand the Indian Banking System for making investment decisions—especially on Commercial Banks’ stocks.

To provide a better understanding and valuable insights to readers, I'm presenting the content in two parts.

In this write-up—Part 1:

Explaining how commercial banks operate and make money.

Discussing the role of the RBI and government regulations that every investor must be aware of.

Breaking down different types of commercial banks, their governance, and their systems.

Examining key monetary policy rates and tools.

Notes from the author:

[ Note: Please refer to the footnotes wherever they are inserted for better understanding. Click on the footnote number to jump to the relevant explanation, and click on the numbered list to return to your reading position.]

What do we know as a layman?

We all know that a bank provides financial services and facilities such as loans, transactions, withdrawals, deposits, income, and many more. In simple terms, we know that a bank collects deposits from one batch of customers and lends the amount to the borrowers—the other batch of customers—as a loan. The bank earns the interest on that loan amount, shares a small portion with depositors, and keeps the remaining in its pocket. This is the one we all know, right? But, as an investor, we need to learn much more beyond this. Let's begin the process by identifying different classifications of banks.

Classification Of Indian Banks:

In India, the banks are generally categorized into five groups, excluding the central bank—the Reserve Bank of India (RBI). RBI is the same as the Fed for the USA.

Commercial Banks

Small Finance Banks

Cooperative Banks

Regional Rural Banks (RRBs)

Payment Banks

RBI recognizes these banks as either scheduled or Non-scheduled banks. Scheduled banks are the banks listed in the 2nd Schedule of the RBI Act, 19341 which have access to RBI facilities such as borrowing through the Liquidity Adjustment Facility (LAF)2 and Monetary Policy Instruments such as the Repo Rate3. Such status shall be issued by the RBI upon fulfilling certain criteria. We will see this in more detail at the end of this part.

Commercial Banks:

The commercial banks are full-fledged financial institutions that offer wide range of banking services such as Savings Accounts, Current Accounts, Fixed Deposits, credit and debit cards, Loans, Investment, and Insurance services. Even though Regional Rural Banks, Small Finance Banks, Payment Banks and Cooperative Banks have commercial flavour in their operations, they aren't classified as Commercial Banks due to their restricted scopes, specialized mandates, and ownership structures.

Commercial Banks are comprised of Public Sector Banks (PSB/PSU), Private Sector Banks, and Foreign Banks.

Public Sector Banks: They're known as government banks in which the Government of India (GOI) is the major shareholder—known to be above 50% stake—and are run by the government. The management team is controlled and approved by GOI and RBI. It is usually called PSU Banks. Some of the leading PSU banks are SBI, Bank of Baroda, PNB, IOB, and Canara Bank.

Private Banks: These banks are managed and run by private players. The CEOs and MDs are elected based on board members' decisions followed by shareholders’ approval. However, the RBI will take the final call regarding the approval of appointment or reappointment of CEOs and MDs. This regulatory measure is to ensure these pivotal roles meet the essential standards of competency, leadership integrity, and to maintain the stability and confidence of the banking system. Top players are HDFC, ICICI, Kotak Mahindra Bank, Axis Bank, and IndusInd Bank.

Foreign Banks: These banks are headquartered in other countries and have operational branches in India. Also, in foreign banks, the CEOs of the Indian branches are subject to the approval of RBI, the same as in Indian-origin banks. Some of the prominent foreign banks are HSBC, Citibank, DBS, Bank of America, and Standard Chartered Bank.

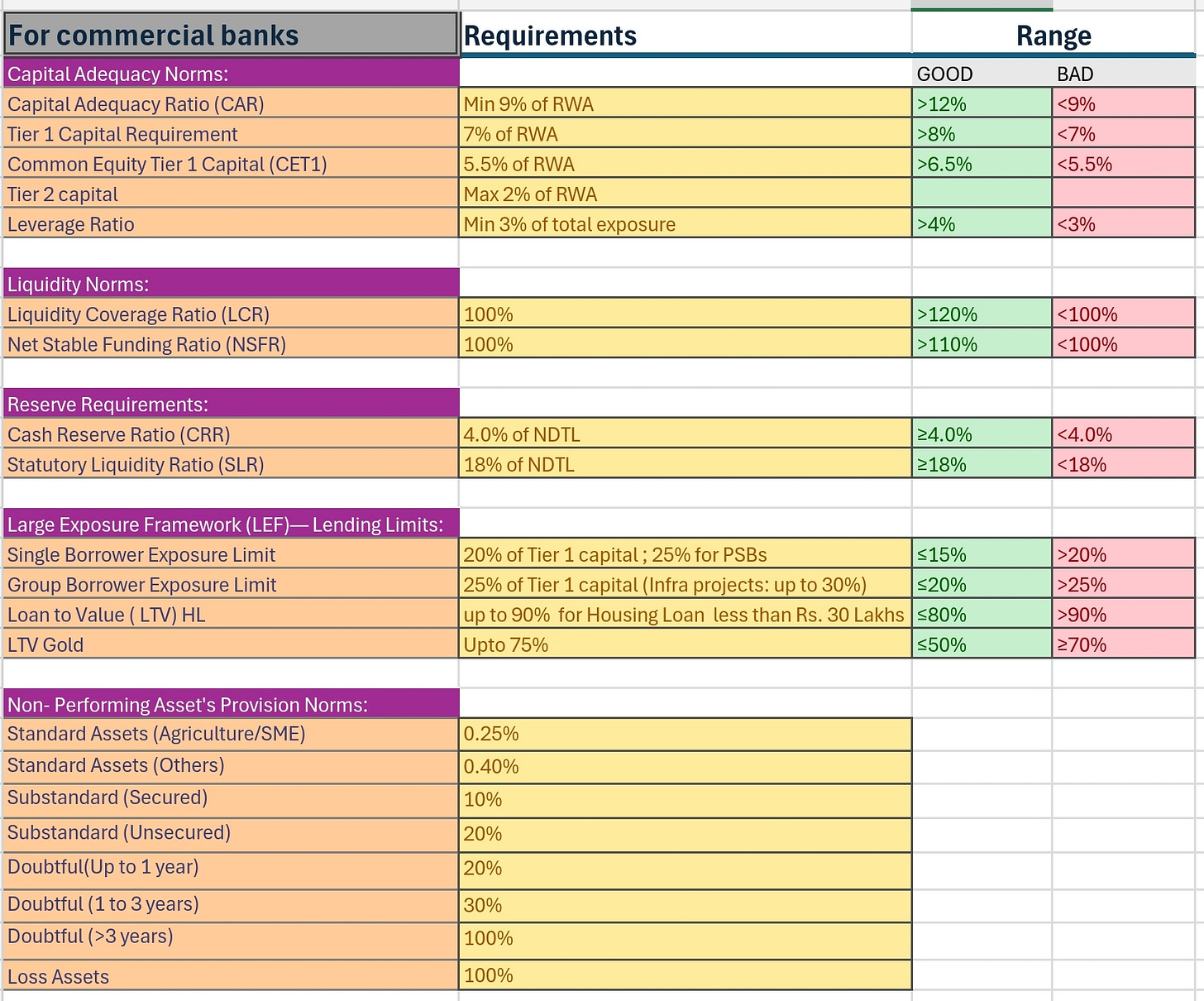

Revenue Streams:

[Note: Under the Indian Accounting Standards (IND AS), the term interest income refers to the interest earned on financial assets. For banks and financial institutions, interest income is their operating revenue. For non-financial firms, interest income is reported under other income.]

1. Revenue from operations:

The banks earn interest income from loans lent to businesses, individuals, and governments—the largest revenue source for banks.

Income from investments in government securities, corporate bonds, and other fixed-income financial instruments.

Income from the cash balance maintained with other banks or the Reserve Bank of India (RBI).

→These revenues are also known as Interest Income.

2. Other Operating Income:

The banks' earnings also come from fees and charges such as account maintenance fees, transaction fees, loan processing fees, and card fees.

Earnings from foreign currency transactions and trading

Revenue from investment banking services such as advisory fees, wealth management fees, and others.

Gain on sale of stocks, bonds, and properties.

Revenue from insurance premiums.

Now, we have a basic understanding of the commercial banks in India. So, it's time to buckle up and dive deeper—especially into regulatory bodies governing commercial banks and the compliance requirements.

Regulatory Framework:

Under the Banking Regulation Act-1949, RBI governs the lending norms, licensing, capital requirements, and other banking operations of commercial banks.

They regulate and make changes in monetary policy4 as per the RBI Act, 1934.

RBI issues Master Circulars and Directions to provide guidelines for banks and financial institutions on regulatory compliance, operational instructions, risk management, and consumer protection.

→The Insolvency and Bankruptcy Board of India (IBBI) :

The primary role of IBBI is to monitor corporate insolvencies and resolve bad loans to help banks recover dues5.

They operate under the Insolvency and Bankruptcy Code (IBC).

However, the IBBI does not regulate banks like the RBI.

The Ministry of Finance governs and regulates only the PSU banks, as the Government of India is the major shareholder of public sector banks.

They make policies and decisions on mergers, acquisitions, recapitalization, and governance.

MoF can demand regular dividends on the profitability of banks to boost government revenue. That's why we often find PSU banks paying more dividends to shareholders.

→Financial Intelligence Unit (FIU-IND):

FIU monitors anti-money laundering under the Prevention of Money Laundering Act (PMLA), 2002.

They collect, analyze, and share financial intelligence to combat money laundering6 and other financial crimes.

→Securities and Exchange Board of India (SEBI):

SEBI regulates the publicly listed banks to comply with the guidelines and regulations to protect shareholders' interests.

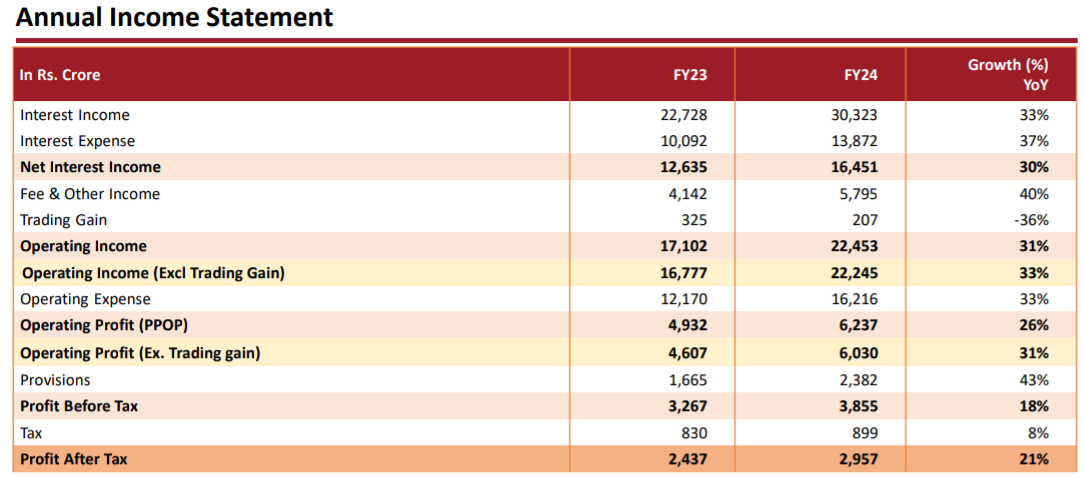

Regulatory Compliance Requirements:

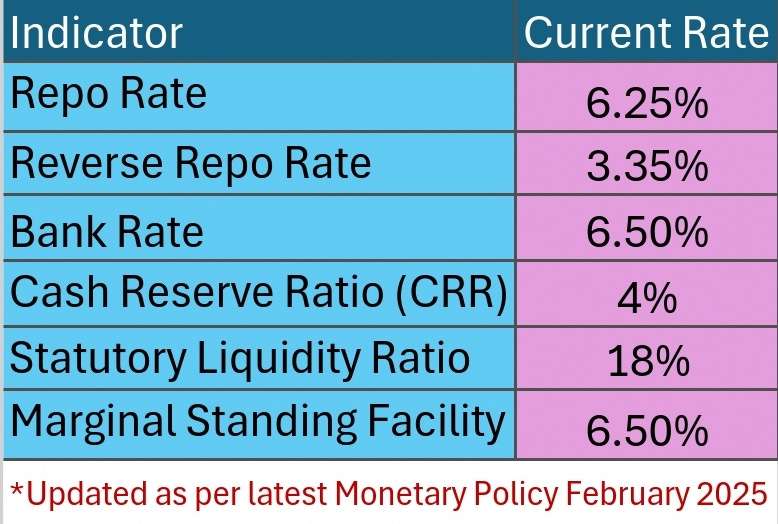

You may wonder what each numbers in the above table indicates. Don't worry, I'm here to breakdown it in such a way so that you can digest it.

As an Investor, we don't need to mug up the numbers. However, we must know where to find those from & how to study those numbers. We must be aware of what each norms indicates. These norms are essential in the banking world. You can find those regulatory disclosure for each quarter by visiting the bank's official website and in annual reports. The purpose of these norms is to ensure the financial stability, prevent excessive risk-taking, and safeguarding depositors’ Interests. By studying those numbers, we can determine the financial stability, risk management and overall stability of the bank.

🧩Capital Adequacy Norms:

These norms help us assess financial strength, risk absorption capacity, and leverage risk.

•Capital Adequacy Ratio (CAR) tells whether the bank has sufficient capital to absorb potential losses such as credit loss, operational loss, and market risks. It is also known as Capital to Risk-Weighted Assets Ratio (CRAR).

CAR = { (Tier 1 capital + Tier 2 capital)×100 }÷ {RWA}

→Tier 1 capital acts as a primary shield against losses. It includes shareholders' equity, retained earnings, and other disclosed reserves.

→Tier 2 capital acts as secondary support during financial stress. It includes general provisions7, debt bonds, hybrid instruments, and revaluation reserves8.

→Common Equity Tier 1 (CET 1) Capital is a subset of Tier 1 capital, including common shares and retained earnings.

→Risk Weighted Assets (RWA) are a bank's total assets that are adjusted for risks. Not all assets carry the same level of risk. For example, government bonds carry a risk weight of 0%, home loans have 35-40%, and unsecured personal loans have 100 to 150% RWA.

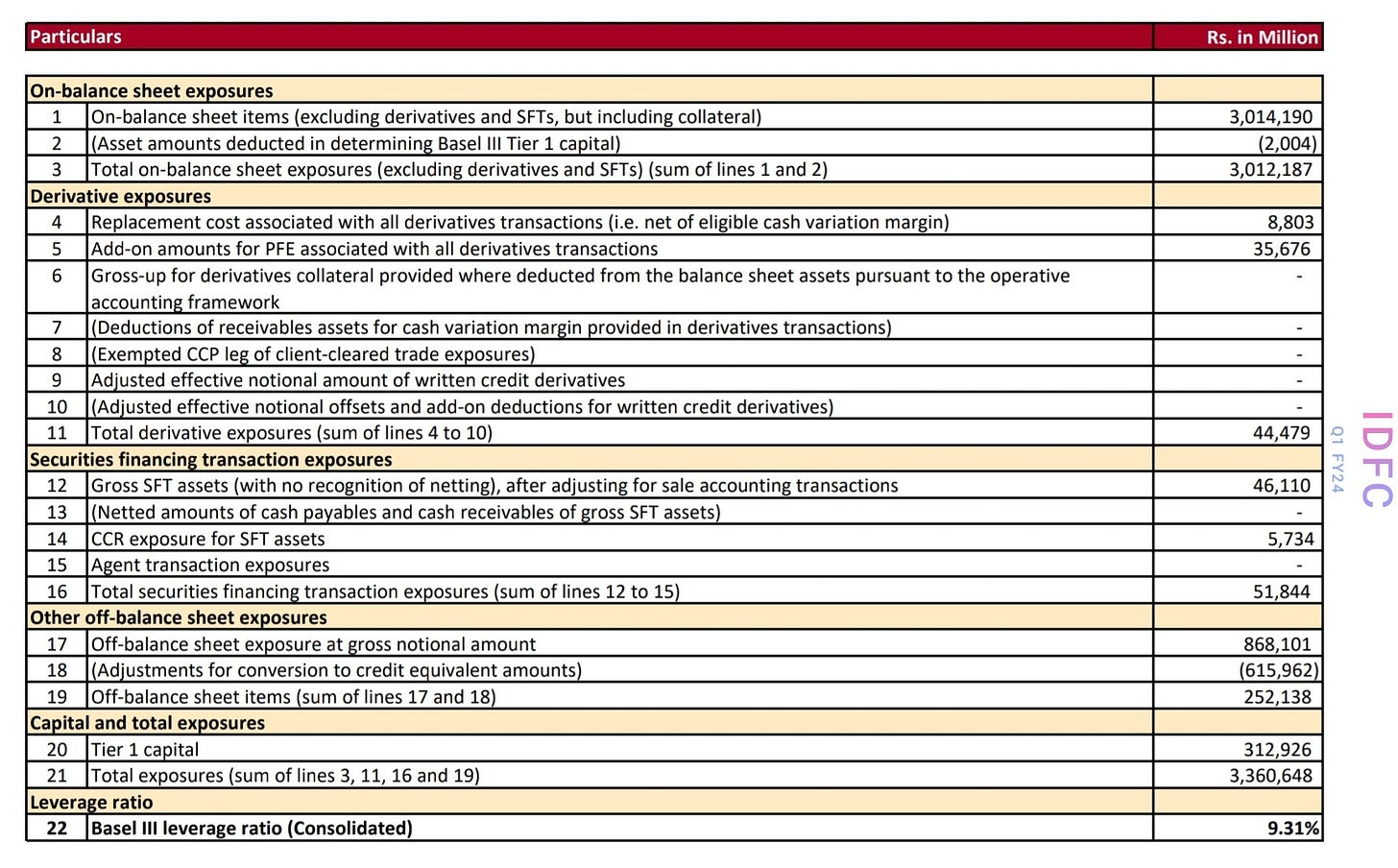

•Leverage Ratio is a non-risk-based measure, and it tells how much capital a bank holds compared to its total assets and total exposure.

Leverage Ratio = Tier 1 Capital ÷ Total Exposure

→Total Exposure not only includes on-balance sheet risks of a bank, but it also includes off-balance sheet risks and commitments such as derivative exposure, securities financing transaction exposure, and other off-balance sheet exposure.

Refer to the attached particulars to get an idea of what off-balance sheet exposure means.

🧩 Liquidity Norms:

These norms help assess whether the bank has adequate liquid assets9 to meet short-term obligations. These are designed to ensure financial stability.

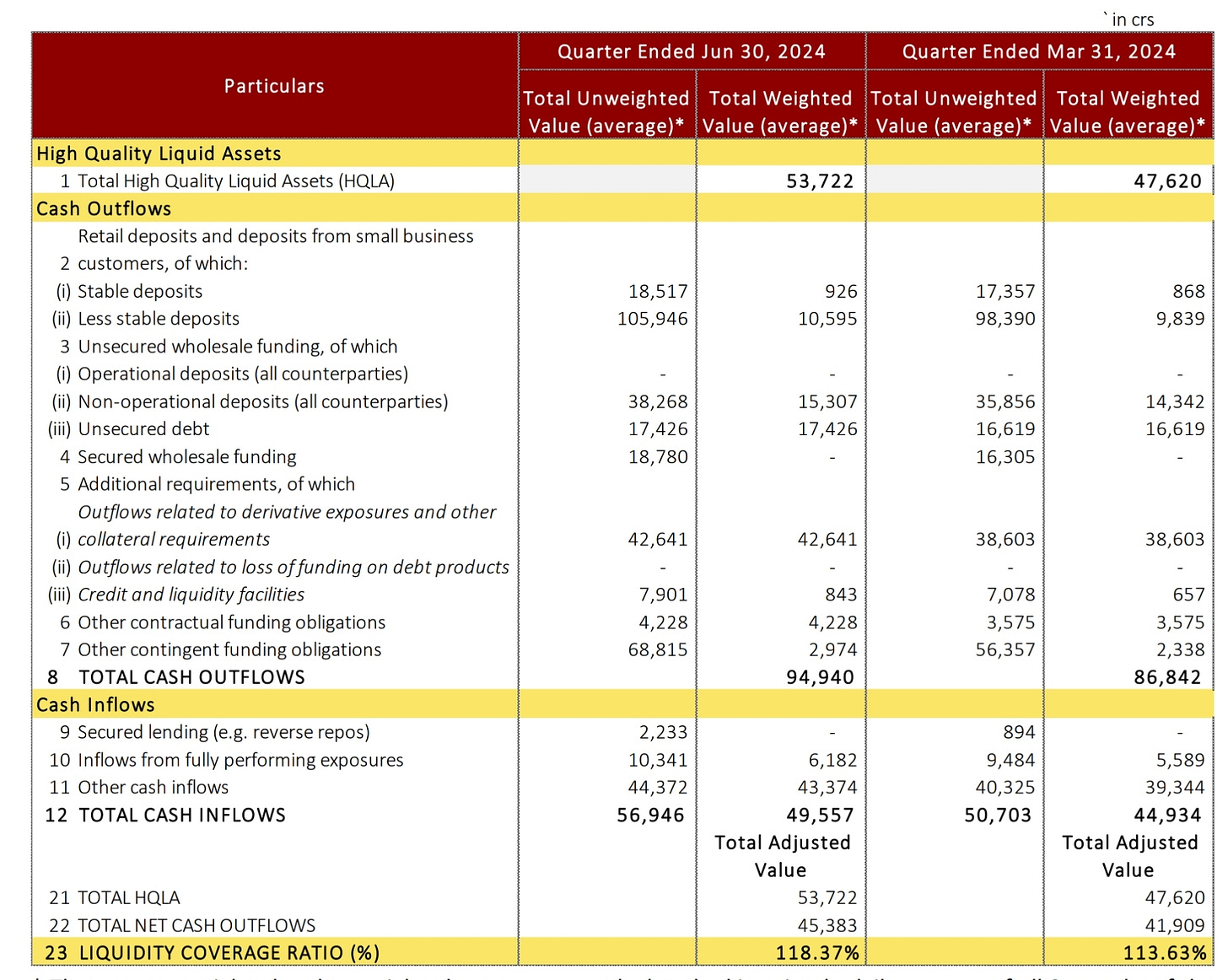

•Liquidity Coverage Ratio (LCR) ensures that the bank maintains adequate High-Quality Liquid Assets (HQLA) to cover short-term liabilities in a specified stress period.

LCR = {HQLA} ÷ {Total Net Cash Outflows over a 30-days stress period}

→HQLA are assets that can be easily converted into cash without significant loss in value.

→Total Net Cash Outflows over a 30-days stress period is the total expected cash outflows minus expected cash inflows over the next 30 days under stressed conditions10.

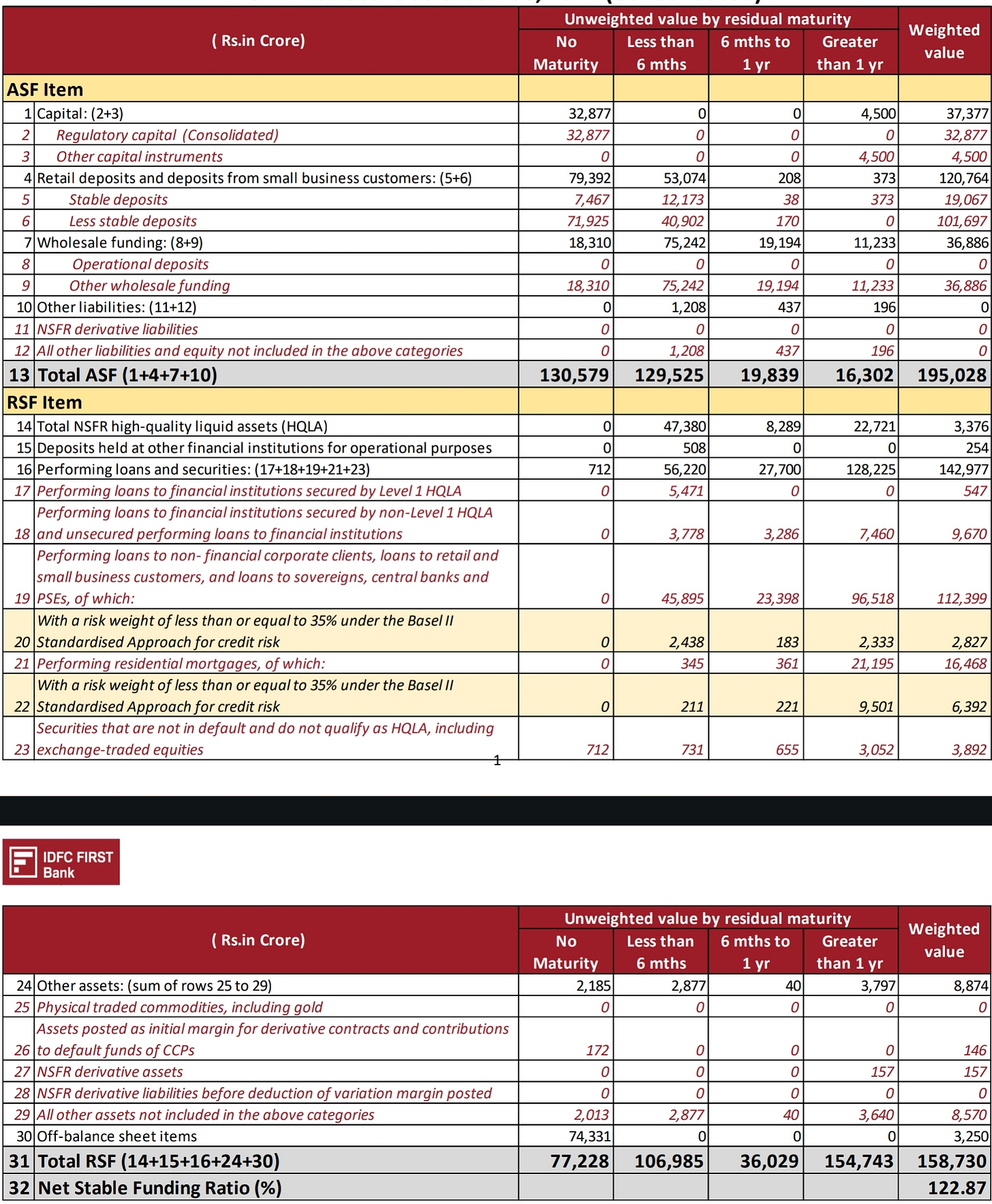

• Net Stable Funding Ratio (NSFR) ensures that banks have sufficient stable funds to support their assets and off-balance sheet activities over a period of one year.

NSFR = {Available Stable Funding} ÷ {Required Stable Funding}

→Available Stable Funding (ASF) means the portion of the bank's funding that is expected to be available for at least one year.

→Required Stable Funding (RSF) means the amount of stable funding a bank needs to hold to cover its assets and off-balance sheet activities11.

🧩Reserve Requirements:

These norms help the RBI maintain a stable banking system while supporting the overall economy. They determine the bank’s lending capacity.

•Cash Reserve Ratio (CRR) means the mandatory percentage of a bank's Net Demand and Time Liabilities (NDTL) that is required to be kept as a reserve in the form of liquid cash with RBI.

CRR amount = CRR rate × NDTL

→As per the latest RBI requirements, the CRR rate is 4% as of February 2025.

→NDTL is the Net Demand and Time Liabilities, which represent the total demand liabilities and time Liabilities12.

• Statutory Liquidity Ratio (SLR) means the mandatory percentage of a bank's NDTL that must be invested in liquid assets such as government securities, cash, and gold.

SLR amount = SLR rate × NDTL

→As per the latest RBI requirements, the SLR rate is 18% as of February 2025.

🧩Lending Limits:

•Large Exposure Framework (LEF) prevents banks from lending too much to a single borrower or a group of borrowers. Basically, this is a lending limit set by RBI.

→As per the latest data, a bank cannot lend more than 20% of its Tier 1 Capital to one borrower and 25% to a group of borrowers. This framework helps banks spread their loan portfolios across many borrowers, enhancing diversification and making the system safer.

→Loan To Value (LTV) is a ratio a bank uses to measure how much of the loan is backed by collateral. It is a part of credit risk assessment13.

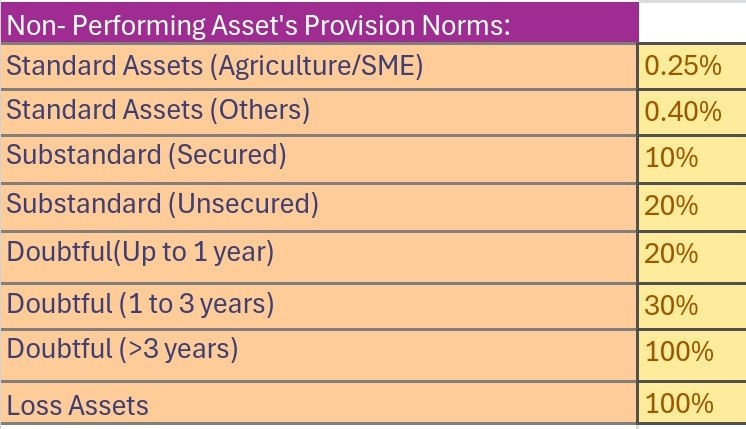

🧩Non Performing Asset’s (NPA) Provision Norms:

These norms require the bank to set aside a certain percentage of its NPA to cover potential losses. These provisions act as a financial backup for banks when loans turn bad.

Understanding Non Performing Assets:

For banks, the loans they lend to companies or individuals are assets. If the borrowers pay the EMI on time, the interest earned on the loan is known as interest income. In this scenario, the loan is considered a Performing Asset. If the borrowers fail to pay on time or default, such loans are regarded as Non-Performing Assets (NPAs). As per RBI norms, a loan is classified as an NPA if the borrower fails to pay interest or principal for 90 days or more.

The aggregate of all the NPAs in a bank is known as Gross Non-Performing Assets (GNPA). A high level of Gross NPA indicates that a large portion of the loan portfolio is turning bad. To cover the potential future loss due to credit default on loans, the bank allocates a certain amount from the profit for the particular period—varies depending on the standards of that Non-Performing Asset. Such an amount is known as provisions. The difference between the Gross NPA and the provisions is the Net Non-Performing Assets (NNPA). This is the loan amount that the bank has no coverage for. The lower the Net NPA, the better it is. A higher Net NPA shows poor risk management and asset quality.

Net NPA = {Gross NPA} - {Provisions}

Key Monetary Policy Rates and Tools:

The RBI Monetary Policy consists of a series of actions taken by the Reserve Bank of India to manage liquidity (money supply), interest rates, and financial stability, as well as to control inflation and support economic growth. It is reviewed at regular intervals (bi-monthly) by the Monetary Policy Committee (MPC). The MPC consists of the Governor of the RBI, the Deputy Governor of the RBI in charge of monetary policy, one RBI official nominated by the Central Board, and three external members appointed by the Government of India.

Let us understand the key rates and tools that the MPC uses to control inflation, manage currency stability, and regulate liquidity in the system.

🏦Bank Rate:

It is the interest rate at which the RBI lends money to commercial banks for long-term loans without the need for collateral.

🏦Repo Rate:

It is the interest rate at which RBI lends short-term loans to commercial banks in exchange for government securities.

🏦Reverse Repo Rate:

It is the interest rate at which commercial banks lend money to RBI in the form of short-term loans secured by government securities.

🏦Cash Reserve Ratio (CRR):

We've already discussed CRR and SLR under the heading ‘Regulatory Compliance Requirements.’ However, let's recollect. CRR is the percentage of a commercial bank’s Net Demand and Time Liabilities (NDTL)—Refer footnote¹¹—that are required to maintain with RBI in the form of cash reserves. This is a mandatory requirement, and the banks do not earn interest on it.

🏦 Statutory Liquidity Ratio (SLR):

SLR is the minimum percentage of a commercial bank's Net Demand and Time Liabilities (NDTL) that it must maintain in the form of liquid assets such as cash, government bonds, or gold.

🏦Marginal Standing Facility (MSF):

The MSF is a facility under which commercial banks can borrow overnight money—during a liquidity crisis—from the RBI with government securities as collateral at a rate higher than the Repo Rate.

The End of Part 1

I hope you gained some valuable insights. We've seen the classification of Indian commercial banks, their revenue streams, regulatory compliance requirements, NPAs, monetary policy rates, and tools. By reading Part 1, I'm pretty sure you now have a good understanding of how Indian commercial banks operate, including their regulatory requirements.

In Part 2, which will be released this Sunday, I'll share a story to connect everything we've learned in Part 1, giving you a clearer picture of the commercial banking business. I will also explain how an investor can analyze the fundamentals of Indian banking stocks—especially commercial banks—to make well-informed investment decisions based on rational thinking.

Stay tuned! Share this post with your friends and family! Subscribe to The Value Investor's Lab! If possible, contribute to support our journey.

⚠️Disclaimer: The Value Investor's Lab is dedicated to providing educational content to help readers understand the principles of value investing. We do not promote or recommend specific companies, securities, or investment strategies. Readers are encouraged to consult registered and approved financial advisors for personalized investment decisions.

The Second Schedule of the Reserve Bank of India Act, 1934, is a list that includes all the banks that fulfil certain eligibility criteria set by the RBI.

LAF is a method or tool used by the RBI to manage liquidity in the banking system through Repo and Reverse Repo operations, allowing banks to borrow or lend money to the RBI for short periods (usually overnight). It helps in managing inflation, interest rates, and overall liquidity in the economy.

The repo rate is the rate at which RBI lends money to commercial banks. A reverse repo is the rate at which RBI borrow money from commercial banks.

RBI's Monetary Policy refers to the central bank's strategy for managing money supply, interest rates, and credit availability (Loan access) in the economy to achieve macroeconomic objectives like inflation control, economic growth, and financial stability.

Insolvency is the financial state where a company is unable to pay their debts on time. It occurs when liabilities exceed assets or when there is insufficient cash flow to meet obligations such as loan repayments, legal liabilities, tax obligations and others.

What is Money Laundering? — Money laundering is the process of converting illegally obtained money—black money—into legitimate-looking money—white money—to hide its true source. This is done through multiple transactions, such as depositing in banks, investing in businesses, or using shell companies, to make the money appear legally earned.

General provisions are the portion of money from profit kept aside to cover for uncertain potential future losses or liabilities. These are recorded as expenses in the income statement.

Hybrid Instruments are financial assets that have the features of both debt and equity such as convertible bonds or preference shares. These are the debts that can be turned into stock later.

Revaluation reserves are the money shows up on a company's balance sheet when the value of its assets, like property or equipment, increases. It's the unrealized gain—like a paper gain until the asset is actually sold.

Revaluation reserves refer to the surplus created when a bank revalues its assets

A bank owns a building valued at ₹100 crore. After a revaluation, its new value is ₹150 crore, creating a ₹50 crore revaluation reserve. If the regulator applies a 55% discount, only ₹22.5 crore (45% of ₹50 crore) will be counted towards Tier 2 capital.

Liquid assets are assets that can be converted into cash quickly, without any significant loss in value. For example, cash and cash equivalents, marketable securities, government bonds, deposits, and others.

Unweighted Value is not adjusted for risks or liquidity whereas in Weighted value, the value is adjusted for the risks or liquidity.

RSF is determined by assigning different weights based on the liquidity risk of each asset. For example: 0% RSF for cash and reserves at Central Banks; 100% RSF for Equity Investments, Non-performing loans, and other illiquid assets.

Demand Liabilities are the funds that depositors can withdraw on demand such as deposits on savings accounts and current accounts.

Time Liabilities are the funds locked in for a fixed period such as Fixed Deposits (FD) and Recurring Deposits (RD)

Credit risk is the possibility of a borrower failing to repay a loan or meet debt obligations, leading to financial loss for the lender. It reflects the chances of default.

This will be very useful for people who wanna learn about Banking. I was searching a good article which encapsulates evey aspect, and fate answered it with your post. Thanks a lot 😊