Infosys has reported a strong Q3 FY25 performance, with revenue growth, expanding margins, and robust deal wins. Let’s break down the key highlights from the earnings call.

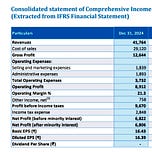

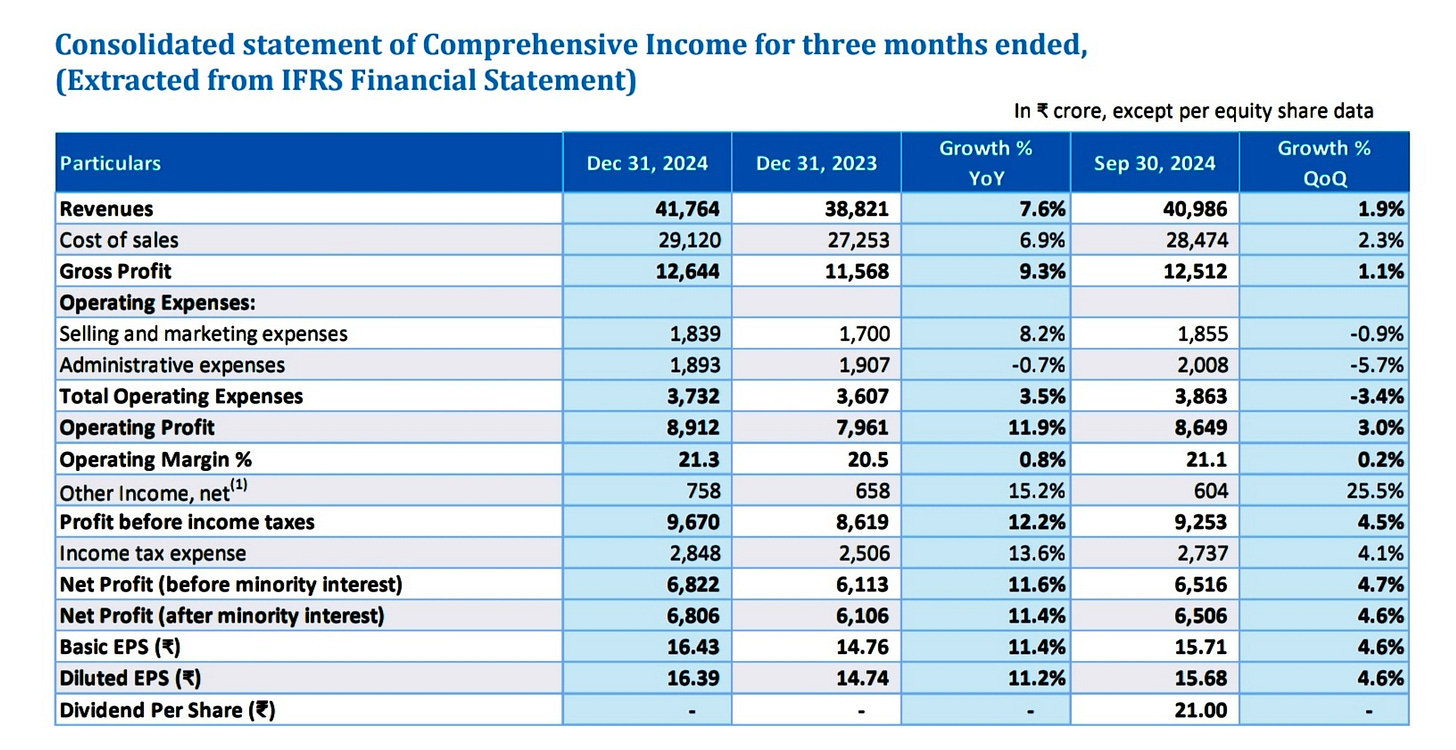

1. Financial Performance

Revenue Growth: 1.7% QoQ, 6.1% YoY (constant currency).

Operating Margin: 21.3% (up 20 bps QoQ, 80 bps YoY).

Free Cash Flow: $1.26 billion (highest ever).

EPS Growth: 11.4% YoY to ₹16.43.

Net Headcount Addition: 5,591 employees, total at 323,000.

Attrition Rate: 13.7% (remains low)—Attrition rate is a metric that measures how many employees leave a company over a period of time.

2. Business Performance by Geography & Industry

Geographical Growth:

North America: Returned to positive growth at 4.88% YoY after four quarters of decline.

Europe: Grew 12.2% YoY, driven by strong financial services and retail segments.

Industry-Specific Trends:

Financial Services: Strong growth in the U.S. and a revival in Europe.

Retail & Consumer Goods: Seeing improvement as discretionary spending picks up.

Manufacturing: Weak in European automotive, but strong in IoT, ERP, and cloud solutions.

Telecom & Utilities: Facing macroeconomic challenges, but energy transition investments continue.

High-Tech: Cost takeout deals driving growth, but some clients are reducing discretionary spending.

3. Large Deals & AI Adoption

Large Deal Wins: $2.5 billion in Q3, with 63% net new business (up 57% QoQ).

Enterprise AI Expansion: Infosys Topaz AI services gaining traction.

Developed 4 small language models (2.5 billion parameters) for banking, IT operations, cybersecurity, and enterprises.

Over 100 AI agents in development for client deployments.

AI Use Cases:

AI-powered research agents for a tech company.

AI-driven audit automation for a professional services firm.

4. FY25 Guidance Update

Revenue Growth Outlook: Revised upwards to 4.5% - 5% (constant currency).

Operating Margin Guidance: Unchanged at 20% - 22%.

5. Key Challenges & Risks

European Auto Sector Slowdown: Demand remains weak.

Telecom Industry Volatility: Cost pressures affecting growth.

AI-Driven Productivity Adjustments: Balancing automation-driven efficiency gains with workforce needs.

Q4 Seasonality & Third-Party Costs: Expected softness due to lower working days and pass-through revenue normalization.

6. Large Deals Breakdown & Future Outlook

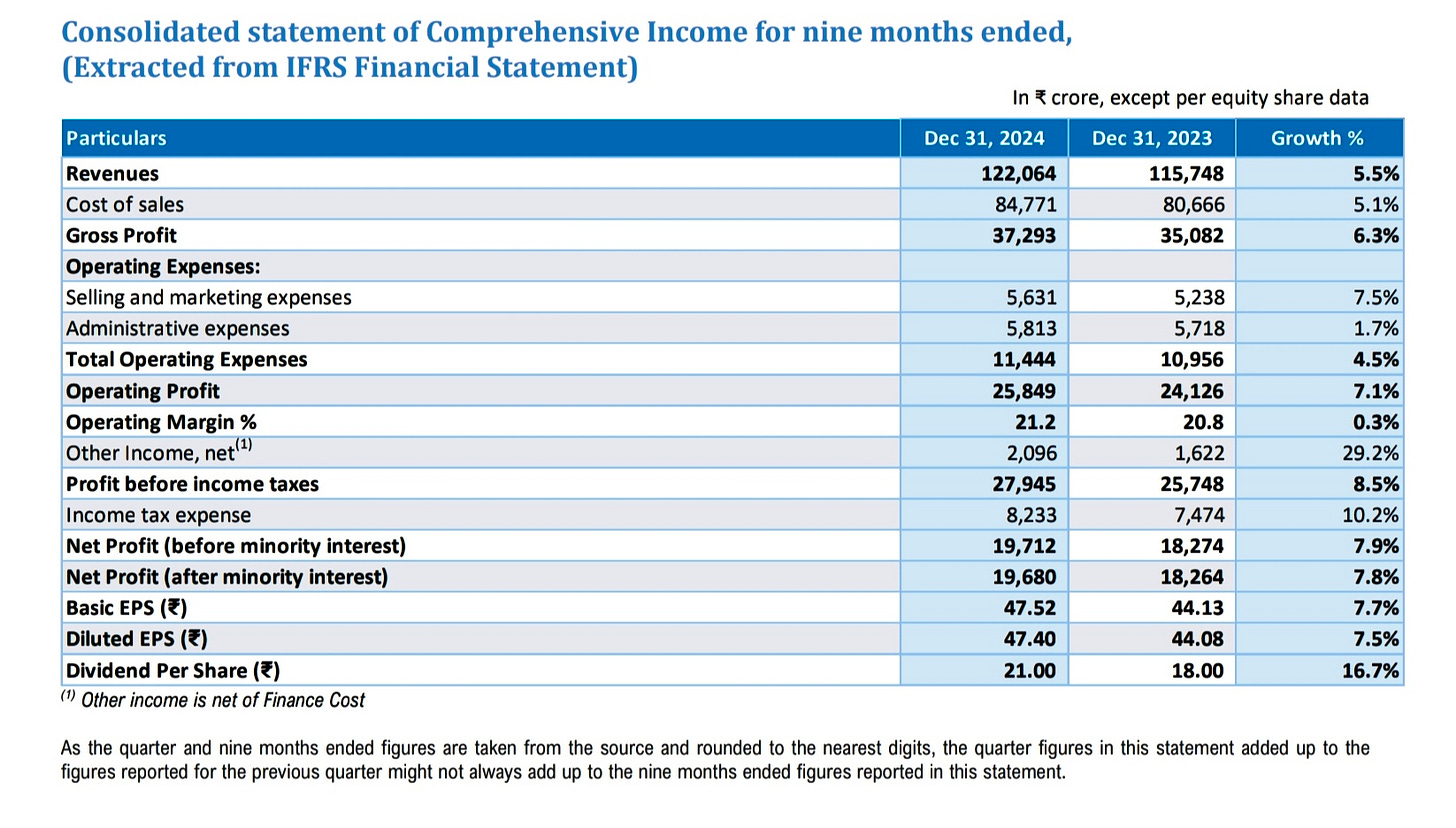

Infosys secured 17 large deals worth $2.5 billion in Q3, with 63% being net new business, reflecting strong expansion.

Sector-Wise Deal Wins:

Financial Services: 5 deals.

Communications: 4 deals.

Manufacturing: 3 deals.

Retail & CPG: 2 deals.

Energy & Utilities: 2 deals.

High-Tech: 1 deal.

Region-Wise Split:

Americas: 11 deals.

Europe: 6 deals.

Deal Pipeline Strength

Q3 saw an increase in large deal pipeline, indicating continued momentum.

Year-to-date (9M FY25): 72 large deals signed with a total contract value (TCV) of $9 billion.

Third-Party Costs & Pass-Through Revenue

Infosys acknowledged a rise in third-party software and hardware costs, which inflated revenues temporarily in Q3. However, these are expected to normalize in Q4, leading to some revenue softness.

7. Margin & Pricing Strategy

Infosys continues its value-based pricing approach, which helped drive a 3.6% YoY realization increase over 9M FY25.

Margin Expansion Initiatives:

Project Maximus: Led to better cost efficiencies.

AI-Driven Productivity Gains: Increased automation in IT operations and development.

Utilization Rate: 86% (above the comfort range of 83-85%).

Future Margin Outlook:

Q4 wage hikes to be phased in:

India employees: 6-8% salary hike.

International employees: Low single-digit hikes.

Third-party cost normalization may offset wage hike impact to some extent.

8. AI & Digital Transformation

Infosys is making a big bet on AI, with its Topaz AI-powered solutions being widely adopted.

Key AI Developments:

Enterprise AI Demand: Strong interest from BFSI, retail, and manufacturing.

AI-Led Cost Takeout Deals: Helping clients reduce operational costs and increase automation.

Building AI Agents for Clients:

AI-powered research agent for a tech company.

AI-driven audit automation for a professional services firm.

AI-based IT operations assistant.

AI’s Impact on Infosys’ Business Model:

AI deployment is expanding revenue opportunities, rather than replacing existing work.

Infosys is moving towards an AI-as-a-service model, where clients pay for continuous AI capabilities.

Small language models (SLMs) being developed in-house give Infosys a competitive edge.

9. Sector-Specific Insights

Financial Services (FSI)

U.S. banking sector remains strong.

European financial services recovery gaining traction.

Cards & Payments: Increased spending observed.

Mortgage & Capital Markets: Seeing gradual revival.

Retail & Consumer Goods (CPG)

U.S. retail demand rebounding, driven by strong holiday sales and improved consumer sentiment.

Clients investing in SAP S/4HANA migration and digital transformation.

Manufacturing

European automotive sector remains weak, but demand for cloud, ERP, and supply chain transformation is high.

Vendor consolidation benefits helping Infosys secure larger contracts.

Energy & Utilities

Increased investment in renewable energy infrastructure to support data centers.

Rising geopolitical risks affecting supply chains.

High-Tech & Communications

Clients cutting costs on legacy systems, but spending on cloud and AI-driven analytics is rising.

Telecom sector under pressure, discretionary spending remains soft.

10. Q4 & FY26 Growth Outlook

Infosys’ Guidance for FY25:

Revenue growth: Raised to 4.5% - 5% (constant currency).

Operating margin: Retained at 20% - 22%.

Large deals pipeline: Strengthening, with strong net new TCV contribution.

Challenges & Risks for Q4:

Lower working days & seasonality impact.

Normalization of third-party costs.

Wage hike impact on margins.

FY26 Outlook:

AI & automation-led efficiencies to drive productivity & pricing improvements.

Continued expansion in financial services & retail.

Large deals translating into steady revenue growth.

Final Thoughts

Infosys is navigating macroeconomic headwinds well, leveraging AI, cost optimization, and strong deal wins to maintain growth momentum.

AI is becoming a significant revenue driver.

Europe & U.S. financial services are rebounding.

Retail & consumer demand in the U.S. is improving.

Third-party costs & wage hikes are short-term challenges.

Infosys’ upgraded guidance for FY25 and strong deal pipeline for FY26 indicate confidence in future growth.

Infosys continues to demonstrate resilient performance with strong financials, expanding AI capabilities, and robust deal momentum. While macroeconomic uncertainties persist, growth in financial services, retail, and AI-driven solutions presents positive tailwinds for FY25.

What’s your take on Infosys’ Q3 results? Let’s discuss in the comments!

⚠️Disclaimer:The Value Investor's Lab is dedicated to providing educational content to help readers understand the principles of value investing. We do not promote or recommend specific companies, securities, or investment strategies. Readers are encouraged to consult registered and approved financial advisors for personalized investment decisions.

Share this post