Maruti Suzuki India Limited (MSIL) reported its Q3 FY25 earnings, highlighting strong sales growth, expanding exports, and a strategic push into electric vehicles (EVs). This report breaks down the key financial and operational highlights in an easy-to-understand manner for beginner investors.

Financial Performance

1. Revenue & Profitability

Net sales reached an all-time high of ₹368 billion, up from ₹386 billion in Q3 FY24.

Net profit stood at ₹35.25 billion, up 12.6% YoY.

Operating profit margin declined to 10% (from 10.3% in Q2) due to:

Higher sales promotion expenses (+20 basis points).

Increased advertising costs for new model launches (40 basis points impact).

Adverse forex movement (20 basis points impact).

Higher depreciation costs due to the new Greenfield plant at Kharkhoda.

2. Nine-Month Performance (April–December 2024)

Highest-ever 9-month sales volume, revenue, and net profit.

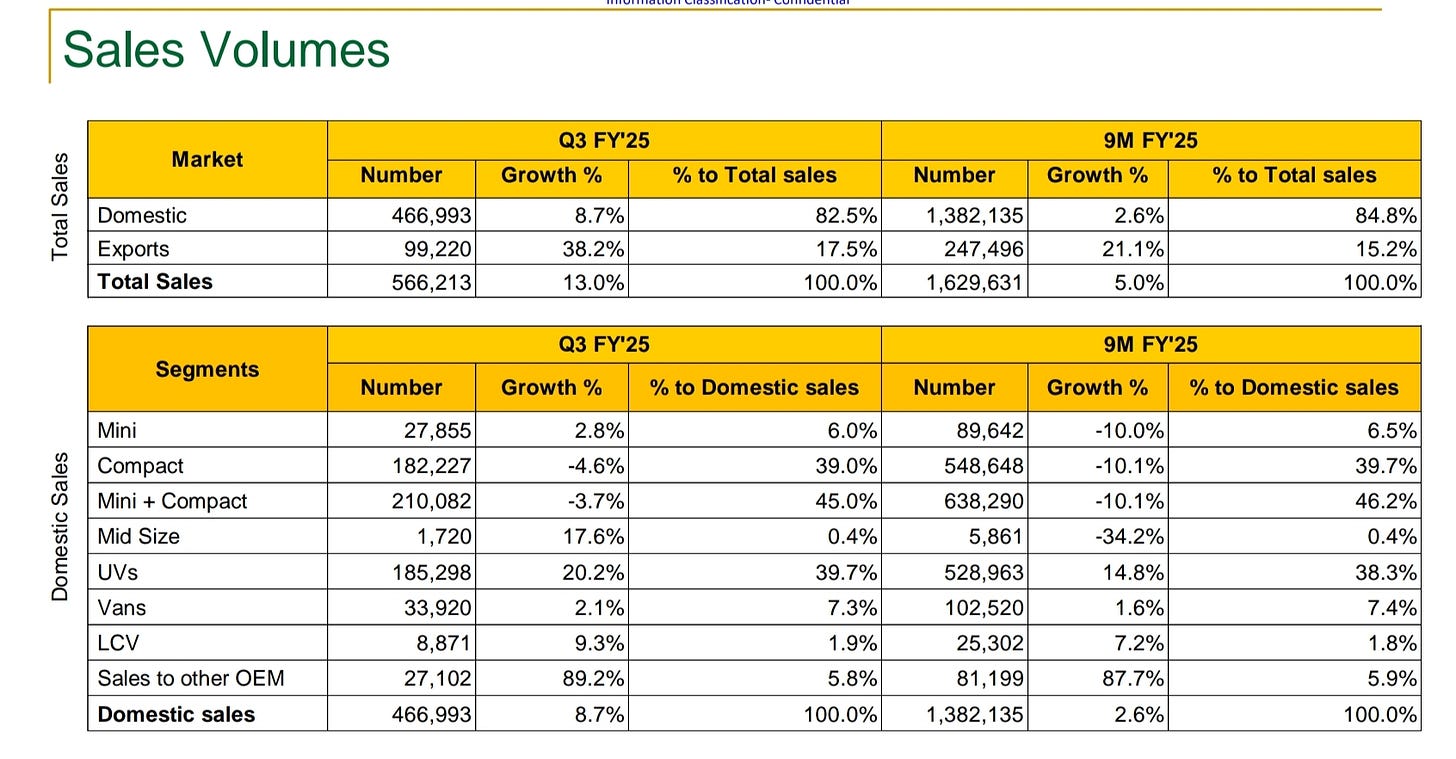

Total sales: 1.63 million units (+5% YoY).

Domestic sales: 1.38 million units.

Exports: 247,000 units.

Net profit: ₹102.4 billion (vs. ₹93.3 billion in the same period last year).

Sales & Market Performance

Maruti Suzuki sold 566,213 vehicles in Q3 FY25, marking an 8.7% YoY growth.

Domestic sales stood at 466993 units, supported by festive season demand and increased promotional efforts.

Retail sales growth improved to 3.5% in the first nine months of FY25, compared to just 0.4% in H1.

Network stock was down to just 9 days, indicating strong demand.

Record-Breaking Exports

Maruti Suzuki exported 69,220 vehicles, the highest ever in any quarter.

Exports grew 38% YoY, with nearly 50% of all Indian passenger vehicle exports coming from Maruti Suzuki.

Strong demand in Africa, Latin America, and the Middle East drove export growth.

Key Business Developments

1. Launch of Maruti Suzuki’s First Electric SUV – EV Vitara

Maruti Suzuki unveiled its first electric SUV, the EV Vitara, at the Global Mobility Expo 2025.

Built on a dedicated Hardtech E platform, it promises:

500+ km range with a 61 kWh battery.

Advanced safety features, including 7 airbags, Level 2 autonomous driving, and energy-absorbing battery structures.

Smart connectivity with over 60 features through Suzuki Connect.

The EV Vitara will be manufactured exclusively in India and exported to 100+ countries.

2. EV Infrastructure Expansion Strategy

To support EV adoption, Maruti Suzuki is rolling out an EV ecosystem:

Fast charging stations in 100 cities (every 10 km).

1,500+ EV-enabled service workshops in 1,000+ cities.

Roadside assistance for EV owners.

3. Launch of New Maruti Suzuki Dzire

The new Dzire sedan, launched in November, features:

Segment-first features, including an electric sunroof, 360-degree HD camera, and new LED headlamps.

Top-tier safety with 6 airbags and a 5-star crash safety rating.

Best-in-class fuel efficiency with a 1.2L Z-series engine.

The Dzire crossed the 3 million production milestone in December 2024.

4. Strong CNG Vehicle Demand

CNG vehicles made up one-third of Maruti Suzuki’s domestic sales in Q3 FY25, reflecting a growing consumer preference for cost-effective and eco-friendly alternatives.

Industry Trends and Outlook

1. Demand Outlook for FY26

Retail sales growth of 3.5% YoY is expected to continue in Q4 FY25.

Industry-wide growth projections for FY26 will be finalized by February.

Overall demand remains subdued, but Maruti Suzuki is focused on maximizing opportunities.

2. Hatchback vs. SUV Trends

Entry-level hatchbacks are experiencing a decline.

Mid-segment hatchbacks are mostly flat.

Premium hatchbacks are showing positive growth.

SUVs continue to gain market share, with rural markets following urban trends.

Export Strategy

Exports have nearly doubled in the last four years.

Strong growth in Latin America, Africa, and the Middle East.

Maruti Suzuki is leveraging its expanding dealership network and customer service improvements to drive export growth.

EV Strategy and Cost Management

1. EV Cost Optimization Efforts

Maruti Suzuki is focusing on global economies of scale to reduce EV production costs.

The company is not expecting EV profitability to match internal combustion engine (ICE) vehicles in the near term.

Government subsidies and tax benefits play a key role in making EVs viable.

2. Long-Term EV Profitability

The EV Vitara is a premium product, with high-range and advanced safety features.

Higher battery costs mean margins will take time to improve.

Localization of battery production (Suzuki’s upcoming battery plant in Gujarat) could help reduce costs over time.

Competitive Landscape and Future Plans

1. Maruti Suzuki’s Competitive Positioning

Despite rising competition, the company sees it as a positive development that expands the market.

Plans to continue investments in technology, safety, and alternative fuel vehicles.

Presence in all major fuel technologies: EVs, Hybrids, CNG, Biofuels & Flex-fuel vehicles

2. Poduction Expansion

The new Khodiyar (Gujarat) plant is expected to start operations in Q4 FY25.

This will help increase production capacity to meet both domestic and export demand.

Price Increases and Margins

1. Recent Price Hike

Maruti Suzuki announced a small price hike (~0.3% of net sales) starting February.

The increase is aimed at offsetting inflationary pressures and rising input costs.

2. Discount Trends

Discounts remain high despite low inventory levels.

Future discount levels will depend on market conditions and demand trends.

Regulatory and Policy Updates

1. Corporate Average Fuel Economy (CAFE) Norms

The new CAFE-3 norms are yet to be finalized.

Maruti Suzuki is well-positioned due to its broad mix of fuel-efficient vehicles.

The company will adjust its product mix and technology strategy to comply with new regulations.

2. Production-Linked Incentive (PLI) Scheme

Maruti Suzuki is evaluating its eligibility for PLI incentives for EV production.

Exports under the PLI scheme would also qualify for incentives.

Final Thoughts – Q3 FY25 Recap

Record Sales & Exports: Maruti Suzuki sold 566,213 vehicles (+8.7% YoY) and exported 99,220 units (highest ever in a quarter).

EV Expansion: Launched the EV Vitara, targeting 100+ export markets with a 500+ km range and advanced safety features.

New Dzire Success: Strong demand for the new Dzire sedan, featuring 5-star safety, premium features, and best-in-class fuel efficiency.

CNG Growth: 1 in 3 cars sold was a CNG model, showing rising consumer preference for alternative fuels.

Revenue & Profit Growth: Net sales at ₹368 billion (highest ever), net profit at ₹35.25 billion (+12.6% YoY).

Margin Pressure: Operating margin at 10% (vs. 10.3% in Q2) due to higher promotions, forex losses, and new plant depreciation costs.

Rural vs. Urban Demand: Rural sales grew 15% YoY, outperforming urban sales (2.5% YoY growth).

Price Hike & Discounts: 0.3% price increase in February 2025, with stable discount levels (~₹31,000 per vehicle).

Capacity Expansion: New Kharkhoda plant to start in Q4 FY25, supporting future production growth.

Competitive Outlook: Industry-wide capacity expansion could increase competition in FY26.

Maruti Suzuki’s Q3 FY25 results reflect steady growth, strong exports, and strategic expansion into EVs. While demand remains moderate, the company’s cost efficiency, product innovation, and global reach position it well for the future. With a strong market presence across fuel technologies and a focus on electrification, Maruti Suzuki remains a key player in India's evolving automotive landscape.

That concludes our Earnings Spotlight for Maruti Suzuki India’s Q3 FY25 results. Stay tuned for more insights on The Value Investor’s Lab!

⚠️Disclaimer:The Value Investor's Lab is dedicated to providing educational content to help readers understand the principles of value investing. We do not promote or recommend specific companies, securities, or investment strategies. Readers are encouraged to consult registered and approved financial advisors for personalized investment decisions.

Share this post