Tata Consultancy Services (TCS) delivered a steady Q3 FY25 performance despite seasonal headwinds, showcasing strong deal momentum and margin expansion. Let’s dive into the key highlights and what they mean for investors.

Financial Performance

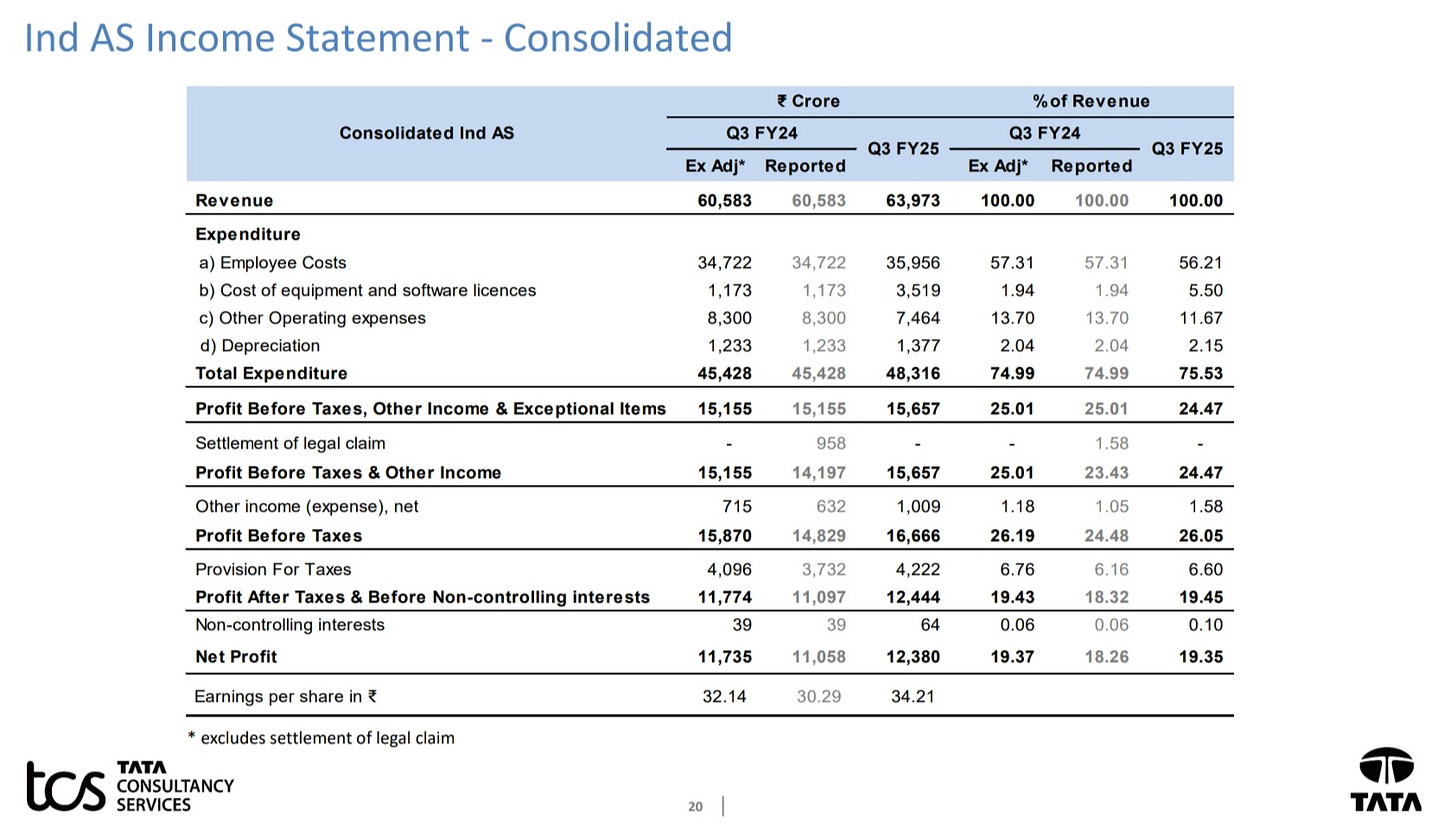

Revenue: ₹63,972 crore (YoY growth: 5.6% in INR, 3.6% in USD)

Constant Currency Growth: 4.5% YoY

Operating Margin: 24.5% (Sequential improvement of 40 basis points)

Net Margin: 19.4%

Earnings Per Share (EPS) Growth: 6.4% YoY

Free Cash Flow: $1.45 billion

Dividend: ₹76 per share (₹10 interim + ₹66 special dividend)

Deal Wins & TCV Strength

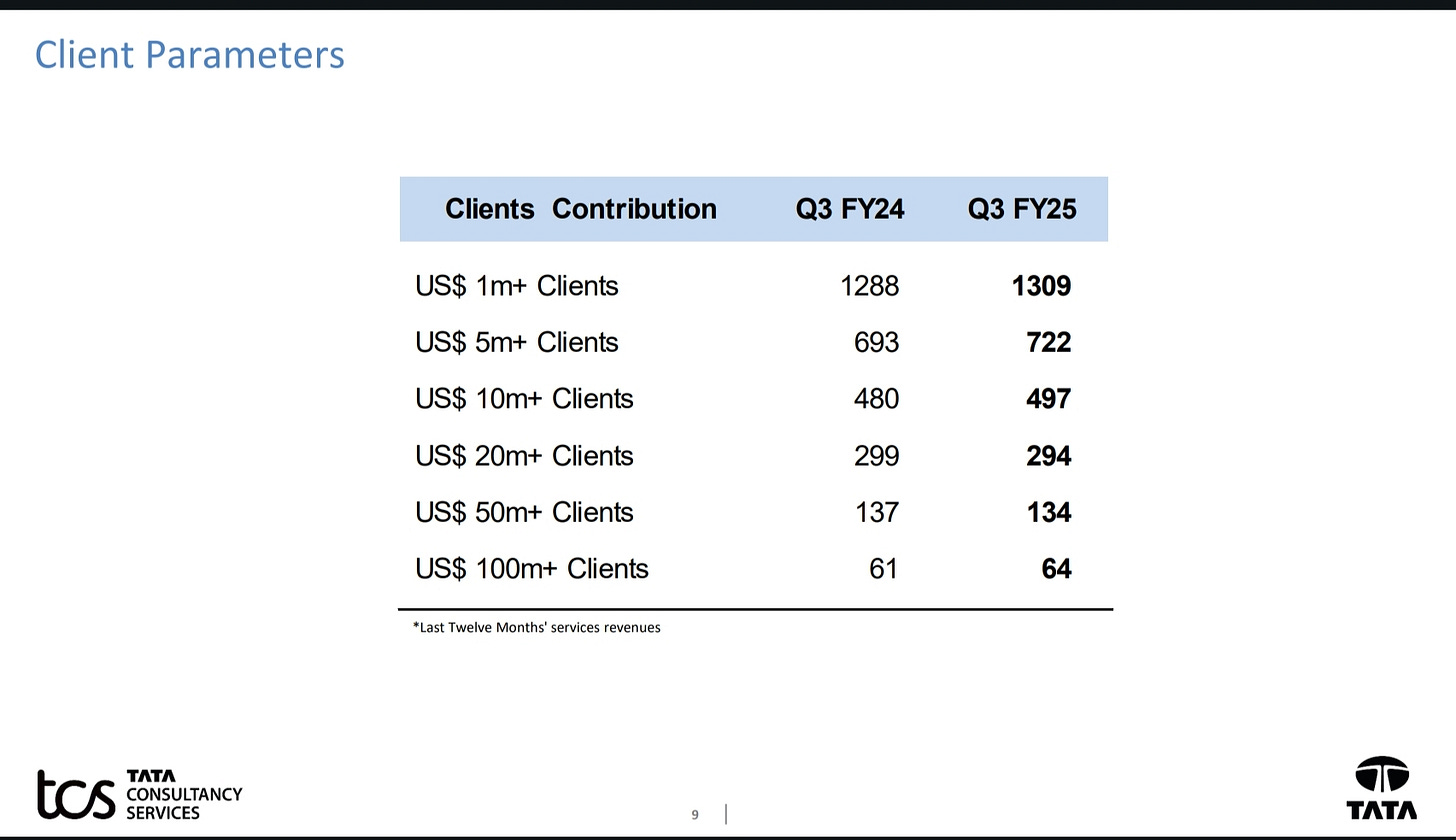

TCS reported an exceptional total contract value (TCV) of $10.2 billion, a double-digit YoY growth in deal signings despite the absence of any mega deals.

North America TCV: $5.9 billion

Banking, Financial Services, and Insurance (BFSI) TCV: $3.2 billion

Consumer Business TCV: $1.3 billion

This robust deal pipeline and early signs of discretionary spending recovery indicate a strong revenue conversion outlook for FY26.

Segmental & Geographical Performance

BFSI: Grew 0.9% YoY; early signs of discretionary spending revival.

Consumer Business: Grew 1.1% YoY, driven by retail recovery.

Manufacturing: 0.4% growth; softness in auto and aerospace.

Life Sciences & Healthcare: Declined 4.3%; awaiting policy clarity.

Technology & Services: Declined 0.4%.

Communication & Media: Declined 10.6%.

Energy, Resources & Utilities: Grew 3.4%.

Regional Markets: Strong 40.9% growth, led by India (+70.2%) and the Middle East (+15%).

While North America (-2.3%) and Europe (-1.5%) saw declines, the UK market grew 4.1%, and growth markets (India, Middle East, Latin America) showed strong momentum

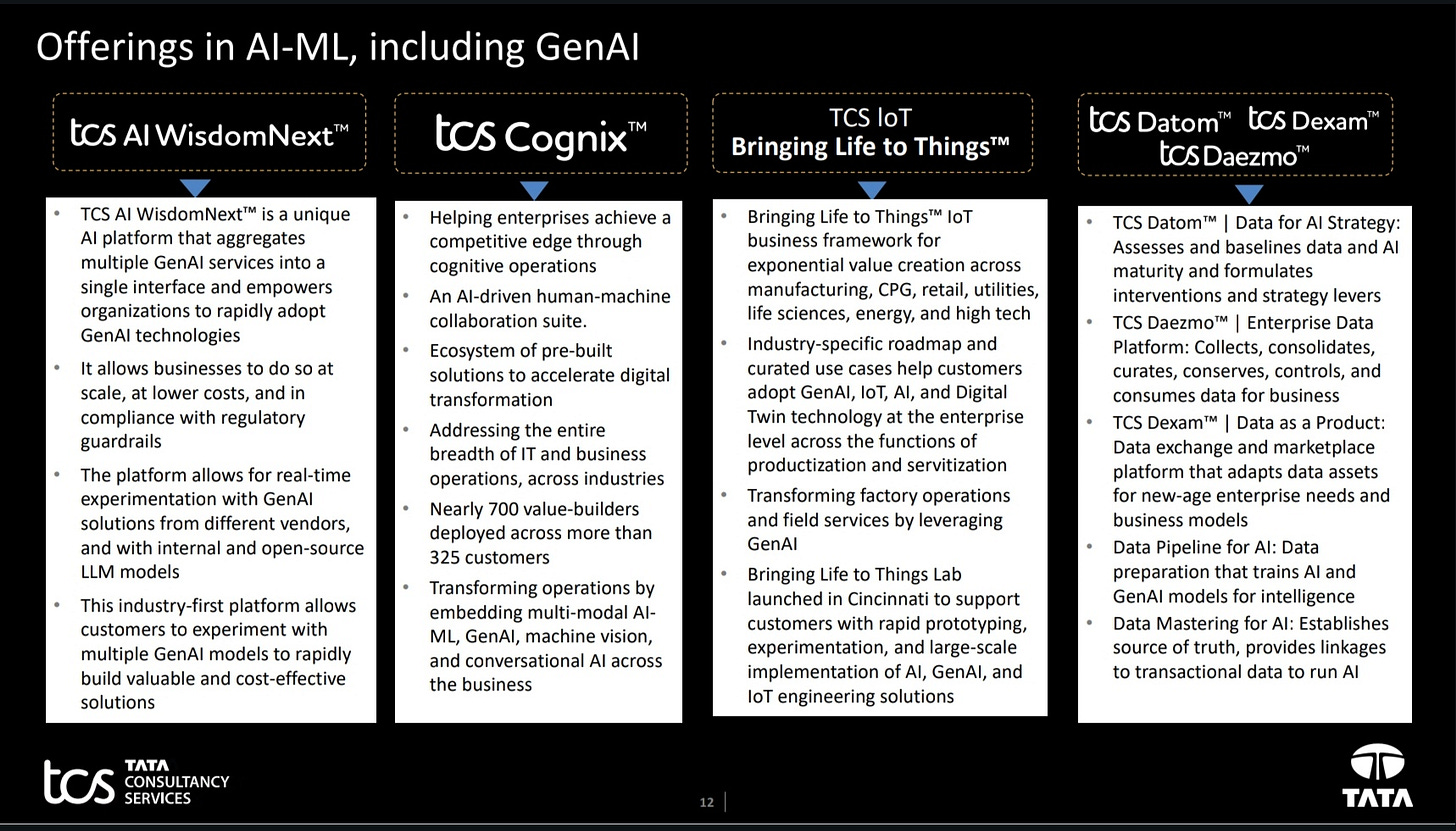

AI & Digital Transformation Driving Growth

TCS continues to see strong traction in AI-driven transformation:

AI-based Drug Discovery: Partnered with a life sciences firm for cancer drug molecule identification.

AI-powered Fraud Detection: A major bank improved fraud detection rates by 18 percentage points.

Retail AI Solutions: Deployed AI for a U.S. luxury fashion retailer to streamline market entry.

Gen AI in IT Modernization: Using AI to enhance mainframe modernization projects

Workforce & Talent Strategy

Total Employees: 617,341

Attrition Rate (LTM, IT Services): 13%

Promotions: 110,000+ in FY25

Campus Hiring: Strong intake planned for FY26

Outlook & Key Takeaways

1. Improving Demand Environment:

Discretionary spending is showing early signs of revival, particularly in BFSI, retail, and manufacturing.

AI, cloud, and digital transformation remain strong investment areas for clients.

Shorter deal cycles indicate improving decision-making confidence.

2. BSNL Contract Tapering:

The ₹1 billion+ BSNL project (4G rollout) is 70% complete and will taper off in Q4 FY25 – Q2 FY26.

TCS is actively looking to replace this revenue with international and domestic opportunities.

3. Margin Expansion on Track:

Q3 saw a 40 bps margin improvement, despite seasonal pressures.

Management remains focused on reaching 26% operating margin in the near term.

4. FY26 Growth Prospects:

While double-digit growth in core markets is not explicitly guided, management expects stronger growth in FY26 compared to FY25.

India’s growth will moderate post-BSNL, but international markets and discretionary IT spending recovery should offset this impact.

I covered the most critical aspects, but here are a few additional insights to further strengthen the analysis.

Additional Insights & Strategic Developments

Capital Allocation & Shareholder Returns

TCS announced a ₹76 per share dividend, including a ₹66 special dividend, reinforcing its commitment to returning capital to shareholders.

The company has not ruled out buybacks, but with recent tax regime changes, dividends may become the preferred mode of capital return.

Industry-Specific Trends & Commentary

Retail & Consumer Business:

Growth is led by essentials, fashion, and apparel.

AI-driven personalization and supply chain optimization are key focus areas.

High-Tech & Semiconductors:

Strong demand from hyperscalers and semiconductor firms. AI infrastructure investments continue, but professional services remain weak.

Life Sciences & Healthcare:

Industry awaiting regulatory clarity in the U.S. before discretionary spending picks up.

Manufacturing & Aerospace:

Auto sector showing signs of revival in North America.

Aerospace demand remains strong due to large order books, but supply chain challenges persist.

AI & Automation – A Growth Catalyst

TCS is actively integrating AI into IT services, automation, and modernization projects.

AI-driven legacy modernization and intelligent automation are helping clients optimize costs while enabling transformation.

No significant revenue cannibalization from AI adoption has been observed yet—AI is seen as a net positive for demand.

BSNL Project & Future Opportunities

BSNL 4G rollout (₹1 billion+ contract) is 70% complete and will taper off gradually.

TCS is actively pursuing global opportunities in telecom and network services, leveraging expertise from this project.

The company is bidding for BSNL’s upcoming 5G project, which could partially offset revenue tapering from the 4G project.

Investor Outlook: Risks & Opportunities

Key Risks:

Macro uncertainties (inflation, trade tariffs, interest rates).

Potential slowdown in India’s revenue growth post-BSNL project completion.

BFSI discretionary spending recovery is still in early stages.

Key Opportunities:

AI-driven IT transformation deals are scaling up.

Strong pipeline in BFSI, retail, and cloud modernization.

TCS’s strong execution and deal momentum position it well for FY26 growth acceleration.

Final Thoughts

Steady Growth Despite Seasonality: Revenue grew 5.6% YoY in INR, with 4.5% constant currency growth.

Strong Deal Wins: $10.2 billion TCV, with broad-based growth across industries and geographies.

Margin Expansion: Operating margin improved 40 bps to 24.5%, with a net margin of 19.4%.

AI & Digital Transformation Driving Demand: Increasing adoption of AI, cloud, and automation solutions across industries.

BSNL Project Tapering: 70% complete; TCS is exploring new opportunities in telecom and network services.

Geographical Performance: India, Middle East, and Latin America showed strong growth, while North America and Europe saw declines.

Capital Allocation: ₹76 per share dividend, including a ₹66 special dividend, reflecting strong cash flow management.

FY26 Outlook: Management expects stronger growth in FY26, driven by discretionary spending revival and deal pipeline conversion.

TCS delivered a solid Q3 despite seasonality, with record TCV, margin expansion, and strong AI-driven deals. While short-term headwinds (BSNL tapering, macro uncertainties) exist, the deal pipeline, improving discretionary spending, and strong execution provide confidence for FY26 growth acceleration.

TCS continues to execute well in a dynamic environment. What are your thoughts on its long-term value potential? Let’s discuss in the comments!

⚠️Disclaimer:The Value Investor's Lab is dedicated to providing educational content to help readers understand the principles of value investing. We do not promote or recommend specific companies, securities, or investment strategies. Readers are encouraged to consult registered and approved financial advisors for personalized investment decisions.

Share this post