Great Eastern Shipping Company Ltd (GE Shipping) recently held its Q3 FY25 earnings call, providing insights into its financial performance, operational highlights, and future outlook. As India’s largest private-sector shipping company, GE Shipping operates in two main segments: shipping and offshore services. This report simplifies the key takeaways from the earnings call to help investors understand how the company is performing and what lies ahead.

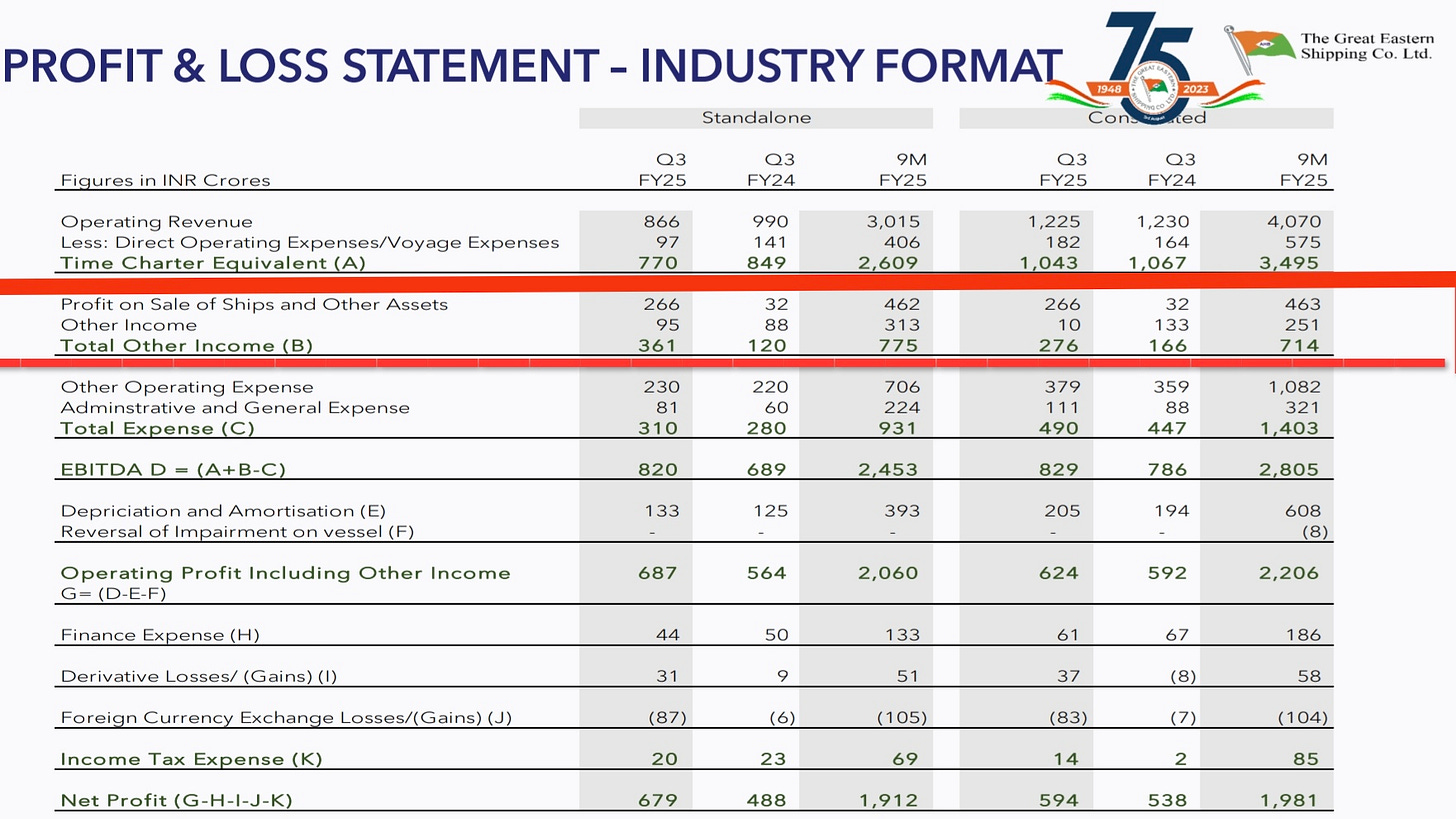

Financial Performance

Revenue increased 7.5% Y-o-Y. This includes the profit gain from selling ship and other Income.

Net Profit: ₹594 crore for Q3 FY25.

Net Asset Value (NAV): ₹1,418 per share, slightly lower than September 2024.

Dividend: ₹8.10 per share, marking the 12th consecutive quarter of dividend payouts.

Net Cash Position: ₹4,280 crore, equivalent to about $500 million on a standalone basis.

The company remains debt-light, with a net debt position of negative ₹4,280 crore, meaning it has more cash than debt.

Asset Value & Fleet Movements

GE Shipping’s fleet value declined by $150 million between September and December 2024. The decline was attributed to:

A drop in market prices for shipping assets

The sale of ships, which shifts value from fleet to cash profits

The impact of softer freight rates in some shipping segments

Despite the decline, GE Shipping’s NAV has grown at a 20%+ CAGR over the past five years.

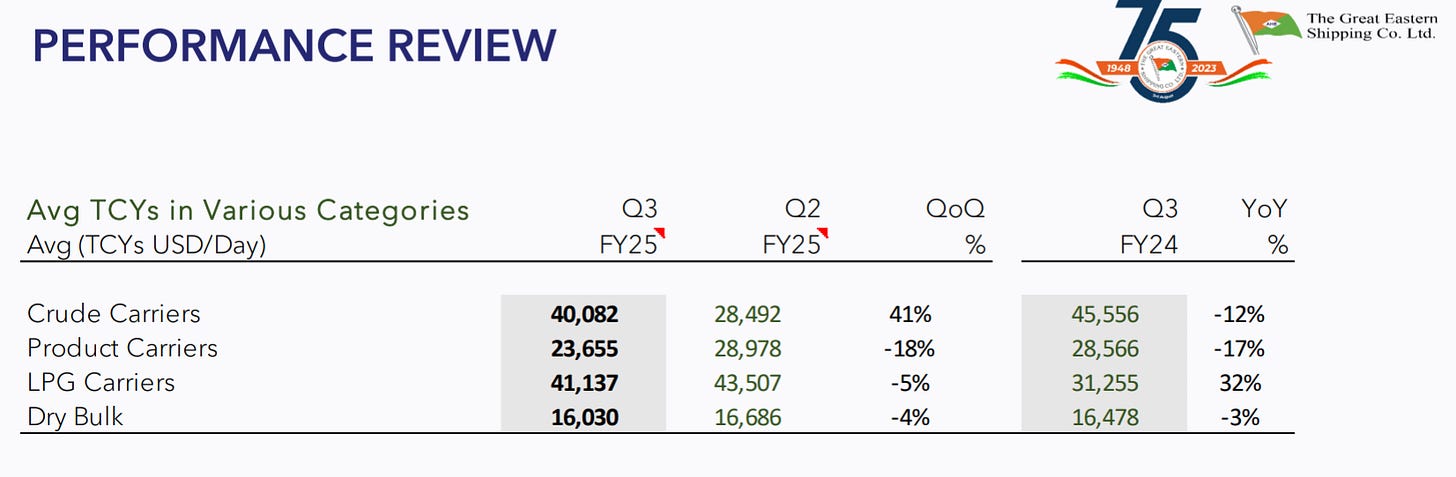

Market Overview & Business Segments

1. Tanker Market

The tanker market underperformed in Q3, with no major winter spike in rates.

Both crude oil and product tanker earnings were lower than last year.

New sanctions on Russian oil tankers caused a temporary surge in rates, but the impact faded.

Oil demand growth was weaker than expected, with a 2% YoY decline in seaborne crude trade.

Refinery throughput in Asia and Europe was lower, reducing demand for tankers.

Fleet Update:

The tanker fleet remained flat, with minimal new deliveries and low scrapping activity.

Asset prices declined by ~15%, especially for older tankers.

2. Dry Bulk Market

Capesize vessels (larger dry bulk carriers) performed better than smaller bulk carriers.

Iron ore trade was weak, driven by:

Slower demand from China

Reduced Brazilian exports due to maintenance at ports

Coal trade grew slightly, but Indian coal imports declined due to higher hydroelectric power generation.

Grain trade saw a sharp decline, as China relied more on domestic supply.

Dry bulk asset prices fell by 5-10%, with smaller ships seeing larger declines.

3. LPG Market (Gas Shipping)

LPG rates dropped significantly from last year’s highs, returning to more "normal" levels.

The Panama Canal restrictions that previously boosted rates have now eased.

Despite lower rates, LPG ship prices remain high, with an order book of 28% of the fleet.

4. Offshore Business (Oil Rigs & Support Vessels)

Rig utilization improved until early 2024 but fell due to contract suspensions by Saudi Aramco.

GE Shipping lost a short-term rig contract in India, which it is disputing.

The company has two rigs up for repricing in H2 FY25 and three more in H1 FY26.

New contracts are being signed at higher rates, supporting profitability.

Industry Trends & Future Outlook

1. New Ship Orders & Supply Impact

The order book for new ships has doubled in the past 12 months, but most deliveries are expected in 2027 and beyond.

Scrapping remains low, leading to a tight market in the near term.

Aging fleets in crude tankers and product tankers may create supply constraints, supporting freight rates.

2. Geopolitical Factors & Sanctions on Russian Oil

180+ Russian tankers were sanctioned, impacting ~50% of Russia’s oil exports.

If these ships exit the market, global tanker demand could rise, tightening supply.

However, Russia may find ways to reroute its oil, reducing the long-term impact.

3. Freight Rate Outlook

Tanker rates remain volatile, with short-term uncertainty.

Dry bulk demand is linked to China’s economy, which remains weak.

LPG rates have normalized, but demand remains strong.

The offshore market is recovering, with higher rig rates expected.

Capital Allocation & Future Growth Plans

1. Ship Acquisitions

GE Shipping prefers buying second-hand ships over new builds.

Management is waiting for further price corrections before making major purchases.

2. Fleet Growth Strategy

The company does not follow a linear growth pattern. Instead, it:

Waits for asset price corrections to buy ships at attractive prices.

Expands rapidly when market conditions are favorable (e.g., 2016-18 fleet expansion).

Focuses on profitability rather than aggressive expansion.

3. Share Buybacks & Dividends

No immediate plans for a share buyback, but management evaluates this option regularly.

The company continues to pay regular dividends, rewarding shareholders.

Q&A Highlights: Key Insights from Management

1. Asset Prices & Investment Strategy

Asset prices have dropped 15% but are still considered high.

The company prefers secondhand ships over new builds for expansion.

Growth will come in a narrow window when ship prices become attractive.

2. Sanctions on Russian Tankers

About 180 tankers (mostly crude carriers) were sanctioned.

These ships carried nearly half of Russia’s crude exports.

If they remain out of service, the market could tighten, benefiting freight rates.

3. Freight Rate Outlook

Crude Tankers: Neutral impact if war-related disruptions ease.

Product Tankers: Increased supply may weaken rates.

Dry Bulk: No major impact from geopolitical factors.

4. Offshore Business & Rig Operations

Three out of four rigs were operational in Q3 FY25.

One rig’s contract was terminated, but the company is disputing it.

Two more rigs are up for repricing in the next two months.

5. Capital Allocation & Buybacks

The company evaluates buybacks vs. fleet expansion but has no immediate plans for buybacks.

Cash is being preserved for opportunistic fleet expansion when asset prices become more attractive.

6. Impact of Order Book on Future Freight Rates

Product Tankers: Large order book could pressure rates in 2025-26.

Crude Tankers & Dry Bulk: Aging fleets may balance supply growth.

LPG Carriers: High order book (28% of fleet) but demand remains strong.

7. Future Growth & Fleet Expansion

The company aims for long-term fleet growth, but expansion will be cyclical, not linear.

Plans to increase fleet size significantly when market conditions allow.

Prefers to buy ships at lower prices rather than expand aggressively in high-priced markets.

8. Potential Impact of War Ending

Freight rates could be impacted in multiple ways, depending on trade route shifts.

No definitive forecast as geopolitical developments remain uncertain.

9. In-Chartering vs. Buying Ships

The company charters ships when asset prices are high to gain market exposure without heavy capital investment.

If prices drop significantly, buying ships will be prioritized over in-chartering.

10. Scrapping & Fleet Ageing

The company has not scrapped ships recently but sells older vessels to other operators.

Some ships may reach scrapping age in the next five years, but decisions will depend on market conditions.

11. Offshore Business & International Expansion

Currently focused on Indian tenders, but international opportunities are being explored.

Offshore earnings remain stable, with three rigs operational and one seeking a new contract.

12. Long-Term Strategy & Market Positioning

The company is not looking to diversify outside shipping or acquire other companies.

Prefers patient capital allocation, waiting for market downturns to expand the fleet at lower costs.

Plans to grow significantly over time, but only when conditions are favorable.

Final Thoughts

Strong Q3 performance following profit gains from selling ships( Other Income), with ₹594 crore in net profit.

Strong Balance Sheet: ₹4,280 crore net cash, well-positioned for downturns.

Market Challenges: Declining asset values, weaker tanker rates, and geopolitical uncertainties.

LPG rates normalized, but fleet values remain high.

Offshore business saw contract disruptions, but new contracts are at higher rates.

Cautious Expansion: Prefers secondhand ships over new builds, waiting for better pricing.

Long-Term Growth Strategy: Will expand the fleet opportunistically, not in a rush.

Paying 12th consecutive quarterly dividend.

GE Shipping continues to navigate market cycles effectively, maintaining a strong balance sheet and cash position. While short-term challenges persist, the company remains well-positioned for future growth.

As always, we provide objective analysis to help you understand earnings reports better. Stay tuned for more insights in our Earnings Spotlight series!

⚠️Disclaimer:The Value Investor's Lab is dedicated to providing educational content to help readers understand the principles of value investing. We do not promote or recommend specific companies, securities, or investment strategies. Readers are encouraged to consult registered and approved financial advisors for personalized investment decisions.

Share this post